Federal Payroll Tax Calendar 2025 – Below, you’ll learn what qualifies as payroll tax, how to calculate payroll tax and how to differentiate payroll tax from income tax. Payroll taxes are payouts to federal and state Although it . FICA — aka Federal Insurance Contributions Act — tax is a U.S. federal payroll tax that is deducted from each paycheck. Overall, the FICA tax rate is 7.65%: 6.2% goes toward Social Security .

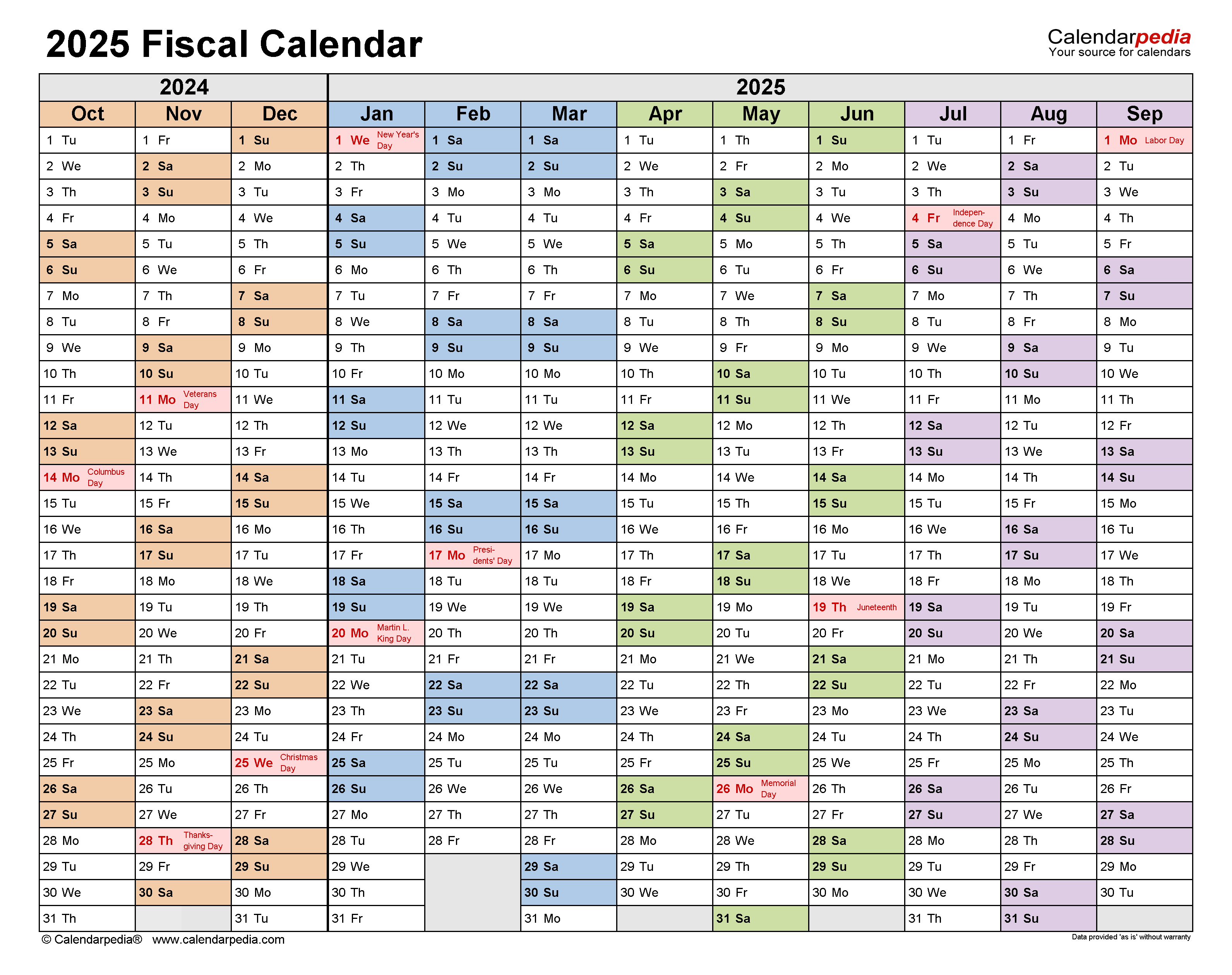

Federal Payroll Tax Calendar 2025

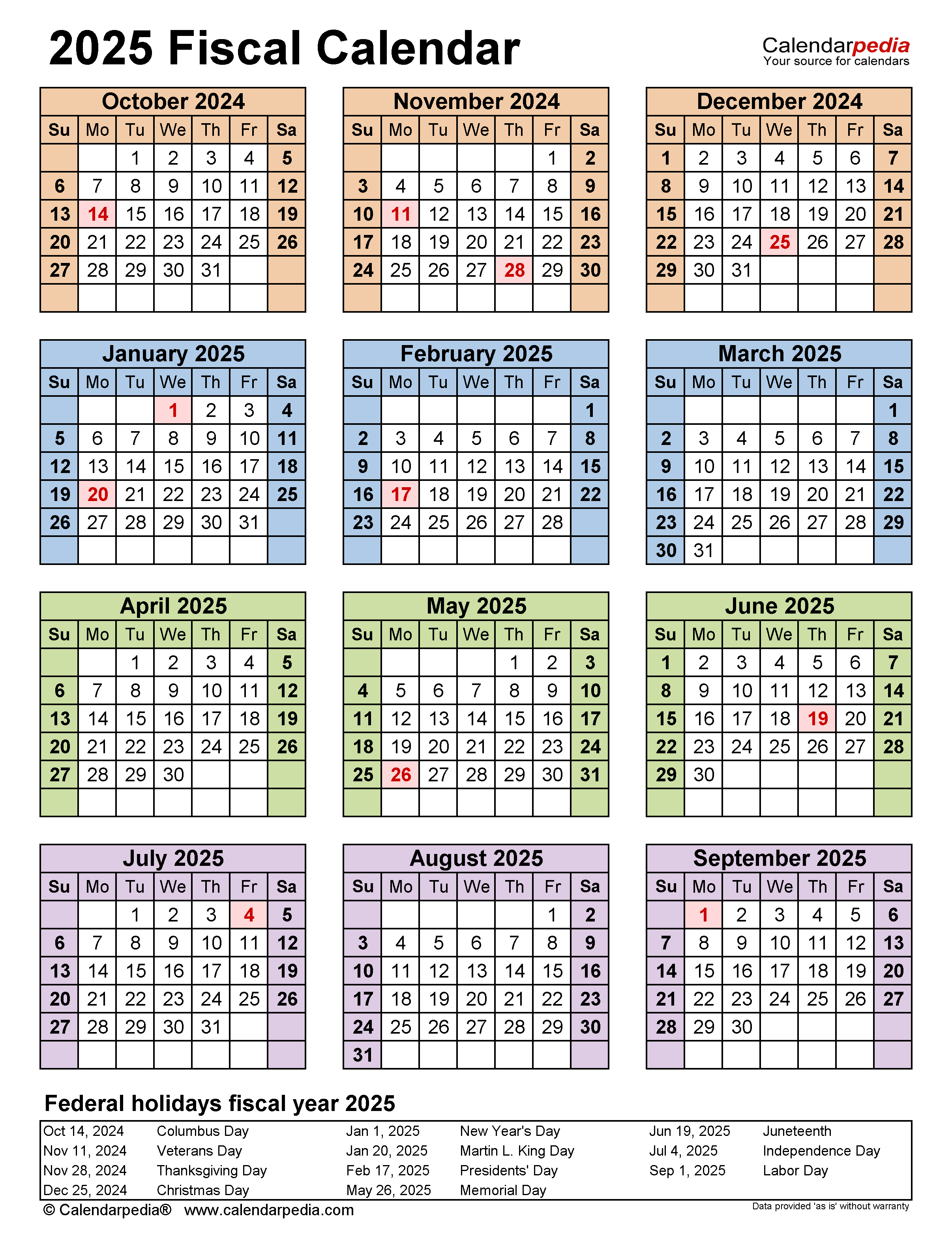

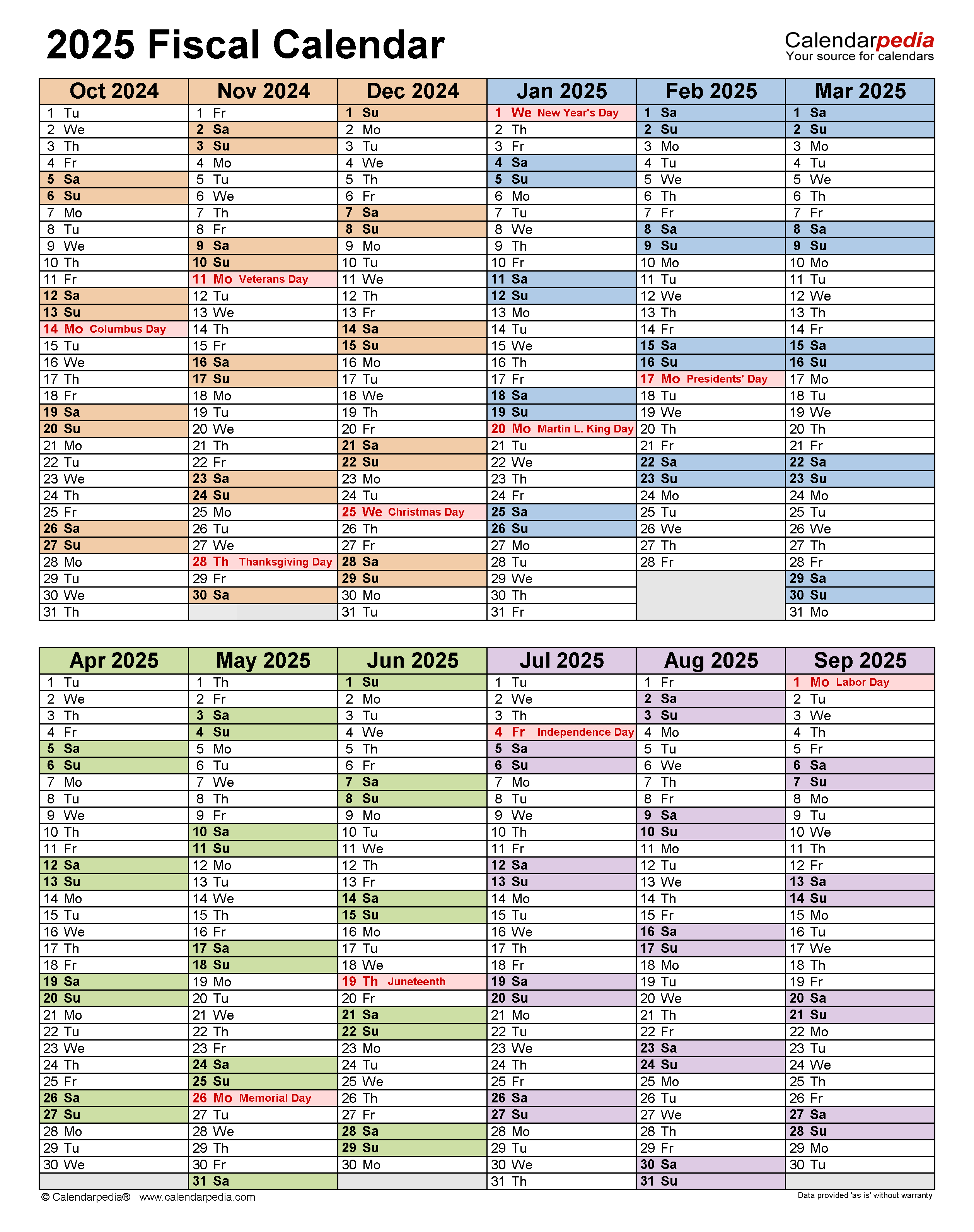

Source : www.calendarpedia.comT18 0067 Baseline Distribution of Income and Federal Taxes, All

Source : www.taxpolicycenter.orgFiscal Calendars 2025 Free Printable Excel templates

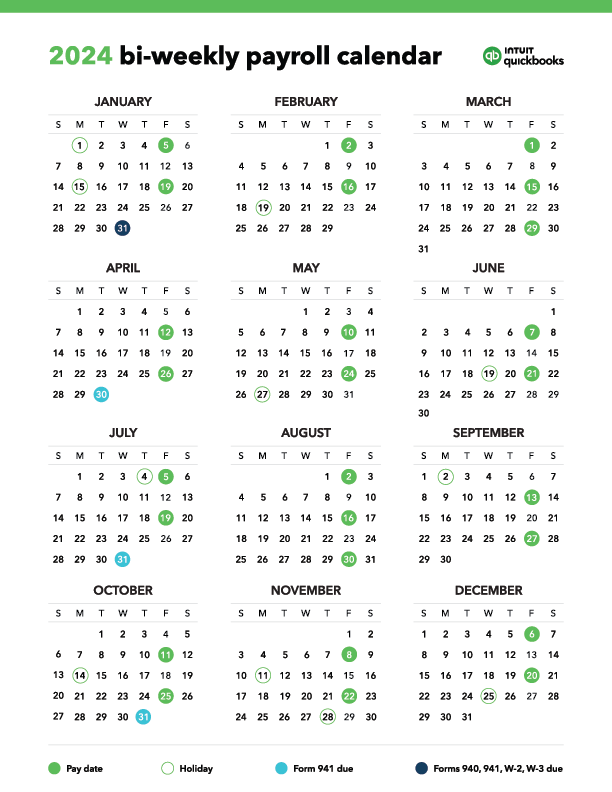

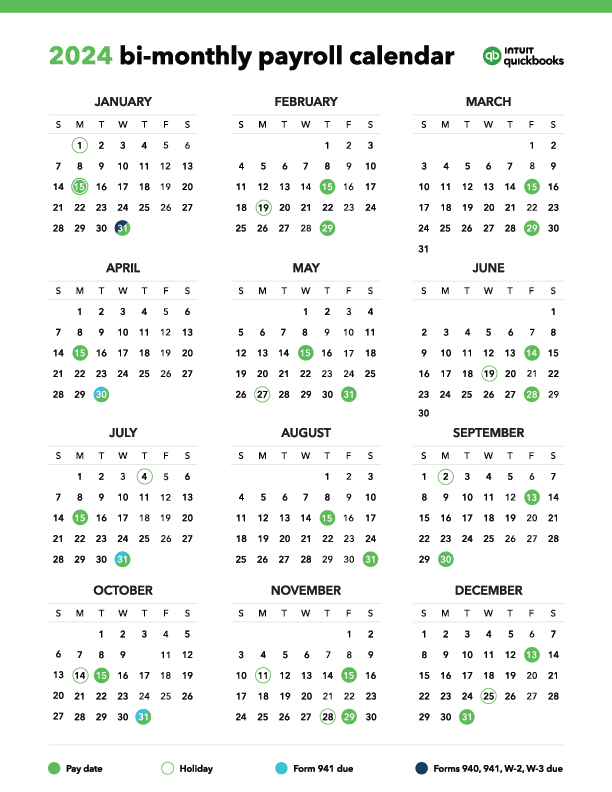

Source : www.calendarpedia.comPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.comFiscal Calendars 2025 Free Printable Excel templates

Source : www.calendarpedia.comPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org2024 Tax Deadlines for the Self Employed

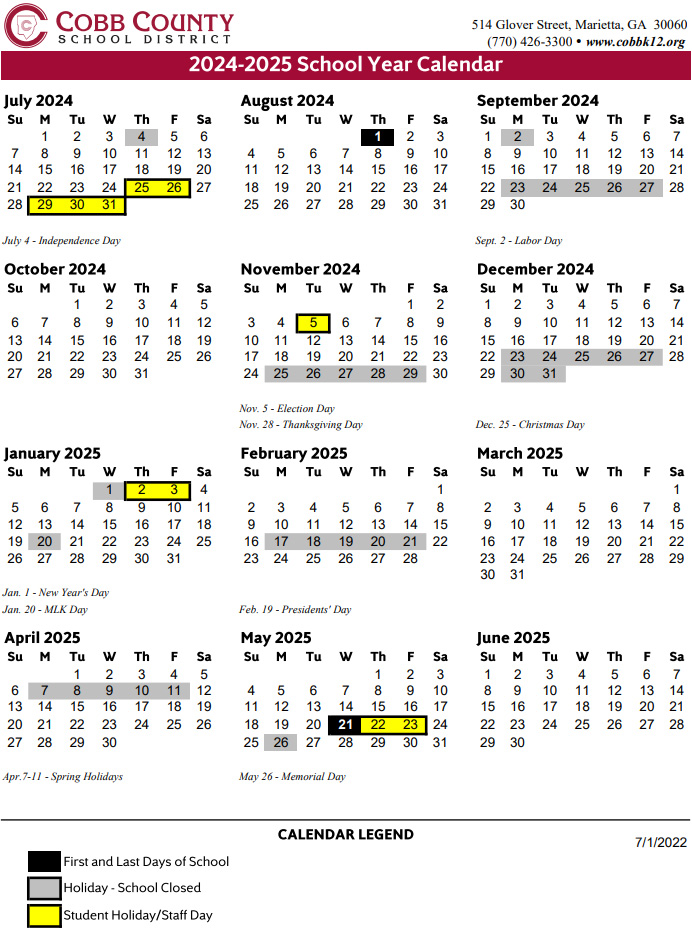

Source : found.comCobb County School Calendar 2024 2025 | Marietta.com

Source : www.marietta.comFiscal Calendars 2025 Free Printable Excel templates

Source : www.calendarpedia.comFederal Payroll Tax Calendar 2025 Fiscal Calendars 2025 Free Printable Excel templates: It calls for doing away with all federal taxes on Social Security benefits, beginning in 2025. There is a cost the cap on the Social Security payroll tax to $250,000. This cap is set at . If you personally employ a nanny, housekeeper, gardener or maid, you may have to pay payroll tax returns. A W-2 form shows what wages an employee was paid during a calendar year and what .

]]>

More Stories

Wcu 2025 2026 Academic Calendar

David M Bird 2025 Calendar

Ysu Spring 2025 Calendar